Florida Housing Market 2026

Florida Housing Market Outlook for 2026: What Buyers and Sellers Should Know

As we move into 2026, Florida’s housing market is entering a more stable and predictable phase after several years of rapid change. While headlines often focus on interest rates or national trends, real estate remains highly local — and understanding both the statewide outlook and Brevard County market dynamics is key to making smart decisions.

Florida Housing Market: Entering 2026 on Firmer Ground

Across Florida, the housing market is no longer defined by extreme bidding wars or runaway price growth. Instead, we’re seeing a healthier, more balanced environment:

Demand remains strong, driven by continued relocation to Florida, particularly among retirees and lifestyle buyers.

Price growth has moderated, giving buyers more breathing room and sellers a clearer sense of realistic market value.

Inventory has increased, offering more choices for buyers while rewarding well-prepared and well-priced listings.

This shift doesn’t signal weakness — it signals normalization. Buyers are taking more time, sellers must be more strategic, and transactions are driven by preparation rather than urgency.

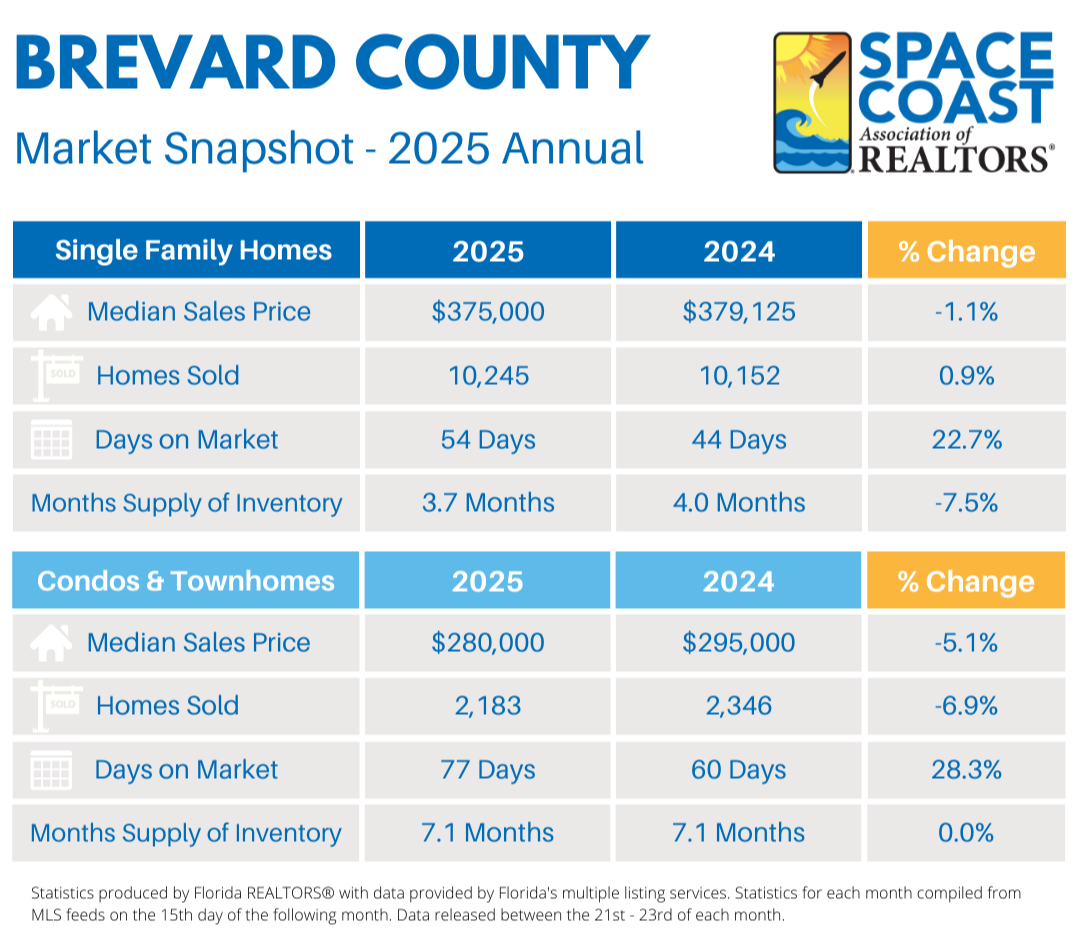

Brevard County 2025 Year-End Snapshot: What the Numbers Tell Us

The Brevard County annual data provides valuable insight into how our local market is behaving compared to statewide trends.

Single-Family Homes

Median Sales Price: $375,000 (down just 1.1% year-over-year)

Homes Sold: 10,245 (slightly higher than 2024)

Days on Market: Increased to 54 days

Inventory: 3.7 months

What this means:Prices have largely held steady, and demand remains solid. However, homes are taking longer to sell, which means buyers are being more selective. Sellers who price accurately and present their homes well are still seeing success, while overpricing leads to longer market times.

Condos & Townhomes

Median Sales Price: $280,000 (down 5.1%)

Homes Sold: Down 6.9%

Days on Market: Increased to 77 days

Inventory: 7.1 months

What this means:This segment is experiencing more pressure. Buyers have options, and pricing sensitivity is high. Condos and townhomes must be positioned carefully, with attention to pricing, condition, HOA health, and assessments.

What This Means for Buyers in 2026

Buyers are entering one of the most favorable environments we’ve seen in years:

More inventory and less competition

Greater ability to negotiate price, repairs, or closing costs

Time to evaluate neighborhoods, floor plans, and long-term value

This is an ideal market for buyers who are prepared and informed.

What This Means for Sellers in 2026

Homes are still selling — but strategy matters more than ever:

Pricing correctly from the start is critical

Presentation and condition impact time on market

Understanding your specific neighborhood matters more than countywide averages

The right approach can still lead to strong outcomes, even in a more balanced market.

Final Thoughts

The 2026 market rewards informed decisions. Whether you’re buying, selling, or simply watching the market, having accurate local insight makes all the difference. Real estate is never one-size-fits-all — and that’s where professional guidance becomes invaluable. If you would like to discuss your situation and options regarding selling or buying in 2026, click HERE to send me a message.

Read More